UNITED RENTALS (URI)·Q4 2025 Earnings Summary

United Rentals Q4 2025: Revenue Beats But EPS Misses by 10%, Stock Drops 6%

January 29, 2026 · by Fintool AI Agent

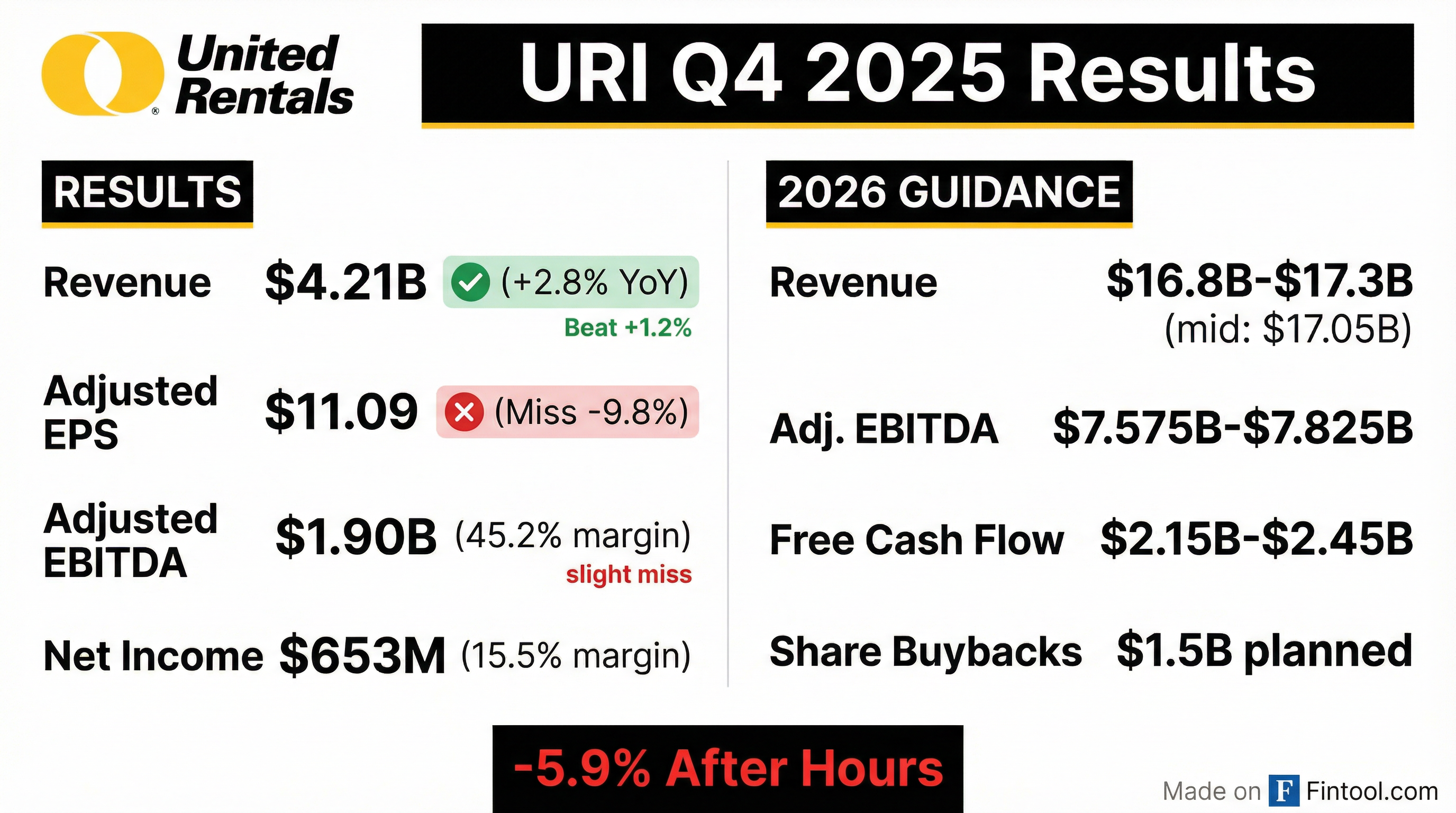

United Rentals delivered a mixed Q4 2025, with revenue edging past estimates but adjusted EPS falling nearly 10% short of consensus expectations. The equipment rental giant posted $4.21B in total revenue (+2.8% YoY) and adjusted EPS of $11.09, well below the $12.29 Street estimate . Shares tumbled approximately 6% in after-hours trading as investors digested the margin compression story that has persisted throughout 2025.

Did United Rentals Beat Earnings?

Revenue: Beat by +1.2% — Q4 revenue of $4.208B exceeded consensus of $4.159B, driven by continued strength in large projects and specialty rental .

Adjusted EPS: Miss by -9.8% — Adjusted EPS of $11.09 significantly missed the $12.29 consensus, reflecting elevated delivery costs and ancillary revenue mix dilution .

Adjusted EBITDA: Slight miss — Q4 Adjusted EBITDA of $1.901B came in at a 45.2% margin, down 120bps YoY from 46.4% .

The year-over-year EPS decline reflects the persistent margin headwinds that have characterized 2025: elevated fleet repositioning costs to serve large projects, lower-margin ancillary revenue outpacing core rental growth, and ongoing inflationary pressures .

Segment-level margin detail reveals the story: Specialty Rentals—URI's growth engine—saw the steepest margin compression, with gross margin falling 520bps YoY to 40.3% . General Rentals fared better with only a 120bps decline to 36.2% . The Specialty decline was driven by higher depreciation (up 140bps as % of revenue), delivery costs for fleet repositioning (up 190bps), and growth in lower-margin ancillary revenues .

What Did Management Say?

CEO Matthew Flannery struck a confident tone despite the margin headwinds:

"I am very pleased that the team's commitment to again double down on being the partner of choice for our customers in 2025 resulted in a year of record revenue and EBITDA. By working hand-in-hand with our customers to provide an unmatched experience across our one-stop-shop of general and specialty rental products and services, coupled with our industry-leading technology, we improved our customers' efficiency and productivity. This ultimately positioned us to outperform the market and generate strong shareholder returns."

On 2026: "In many ways, we expect this year to be similar to 2025, with large projects and dispersed geographic demand driving most of our growth. I am confident our team will build on our momentum while aggressively managing costs, focusing on efficiency, and effectively allocating capital to continue generating long-term value for our shareholders."

Key takeaway: Management acknowledged the margin challenges but emphasized cost discipline and efficiency as priorities for 2026. Cost actions will build progressively through the year, with more benefits in peak activity quarters: "It's something that'll progress. This isn't gonna be a light switch... we'll still have some noise here in Q1, and then as we work through the year, we believe we'll start to see the benefits" .

How Did the Full Year 2025 Perform?

Full year 2025 set records despite margin pressure, with revenue crossing the $16B mark for the first time .

Specialty drove outperformance: Specialty revenue reached $5.87B, representing 36.5% of total revenue and growing at a 20.2% 10-year CAGR . The segment continues to be URI's growth engine, fueled by power & HVAC, trench safety, matting solutions, and the Yak acquisition.

Fleet productivity slowed: Q4 fleet productivity came in at just 0.5%, down from 2.0% in Q3 and 3.3% in Q2 . Management noted this was primarily mix-driven rather than rate or utilization weakness.

What Did Management Guide for 2026?

URI's 2026 outlook implies another year of growth but with limited margin recovery :

Capital allocation priorities for 2026 :

- Organic growth: ~40 specialty cold-starts planned

- M&A: Balance sheet provides flexibility (1.9x net leverage ratio) with $3.322B total liquidity

- Shareholder returns: New $5B share repurchase program authorized, with $1.5B planned for 2026 (including $350M to finish existing program + $1.15B under new program) ; dividend increased 10% to $1.97/quarter

The guidance midpoint of $17.05B revenue implies ~6% growth. Importantly, management clarified the guidance assumes flat local markets—no rebound expected but also no deterioration. Growth will be driven by large projects: "The way we see today, we do not expect there to be big growth in the local market... this does not contemplate a big rebound in the local markets. But to be fair, not a deterioration as well" .

How Did the Stock React?

URI shares dropped approximately 6% in after-hours trading following the report, falling from $903.19 to around $850. The negative reaction reflects:

- EPS miss magnitude: A 10% miss on adjusted EPS is significant for a company that typically beats

- Margin trajectory concerns: EBITDA margins compressed 120bps YoY with limited improvement expected in 2026

- Fleet productivity deceleration: 0.5% in Q4 is the weakest reading in over a year

Year-to-date through January 28, URI shares had risen ~7% (from $845 to $903), significantly trailing the broader industrial sector. The stock is now trading at approximately 15x forward EPS, below its 5-year average multiple.

Q&A Highlights: What Did Analysts Ask?

The earnings call Q&A session revealed several important insights:

On Matting Business Volatility: CFO Ted Grace explained that the Q4 matting shortfall was due to a single large pipeline project being pushed out: "It's a large pipeline project that has simply been pushed out. So we've got the matting contract. We know we're gonna be on it, and the pipeline itself is moving forward." He noted the matting business was up 30% pro forma in 2025 and ahead of the company's goal to double it within five years of acquiring YAK .

The matting business alone accounted for a full 1 point of fleet productivity drag in Q4 due to its classification as "bulk" assets affecting the mix calculation .

On M&A Pipeline: CEO Matt Flannery was bullish on deal opportunities: "The pipeline's pretty robust, and there's some chunky deals in there... specifically when we're looking at opportunities in specialty." The company completed three small deals in Q4 (trench, portable sanitation, and an Australian aerial company) but emphasized they remain "pretty picky" and "the math's gotta work" .

On Mega Projects Outlook: Flannery expressed strong confidence in large project demand: "That pipeline is as big as it's ever been in my 35 years." He added that the guidance does not assume a local market rebound—just steady local conditions with growth driven by large projects .

On Ancillary Services ROI: When asked about returns on margin-dilutive ancillary services, Flannery clarified: "Although these may be margin dilutive, most of these services, if not all, are not capital intense. So these net-net on a cash perspective, these are profitable. They just dilute margins." The services are customer-driven—responding to needs for setup, delivery, and installation rather than sales team initiatives .

On Technology Investments: Grace confirmed tech spend will increase in 2026: "Definitely technology spend will be up in 2026 versus 2025... we continue to try to leverage more and more technology to drive greater operating efficiency." Focus areas include fleet efficiency tools, repositioning cost mitigation, and cybersecurity .

On Used Equipment Market: Grace noted the market has normalized from 2022-2023 extremes: "At this point, we think the used market has normalized... we do expect 2026 to see healthy demand." Q4 OEC sold was below guidance because URI held onto high-time aerial products and telehandlers to meet rental demand .

What Changed From Last Quarter?

Several key dynamics evolved from Q3 to Q4:

Margin pressure persisted: Q3 commentary warned of elevated delivery costs from fleet repositioning to serve large projects . This continued into Q4, with the company noting "the designated restructuring programs generally involve the closure of a large number of branches" .

Fleet productivity declined further: From 2.0% in Q3 to 0.5% in Q4. Management attributed this almost entirely to unfavorable mix, specifically the matting business pushout which alone accounted for 1 full point of drag. Rate and time remained positive, with rate contribution "exactly the same" as Q3 .

2028 aspirational targets remain: Management reiterated confidence in reaching ~$20B revenue, ~$10B EBITDA, and 15%+ ROIC by 2028, though acknowledged "the margins will be more challenging" .

New restructuring program: URI initiated a Q4 restructuring program "associated with the consolidation of certain common functions and certain other cost reduction measures" expected to complete in 2026 .

Competitive Dynamics

When asked about competitive changes following a competitor's recent IPO, Flannery noted the financing change doesn't alter street-level dynamics: "That change of where they get their funding doesn't really change anything on the street. We think the supply-demand dynamics are good." He emphasized industry discipline remains critical: "The industry needs to continue to be disciplined because we've all absorbed price increases on fleet for the past few years" .

What Are the Key Risk Factors?

Management highlighted several ongoing concerns in the earnings materials :

- Tariff exposure: Equipment purchases and cost inflation remain sensitive to trade policy

- Interest rate sensitivity: Higher rates impact construction and industrial activity

- Fleet management challenges: Repositioning costs have proven stickier than expected

- Used equipment market: Normalizing used margins have been a persistent EBITDA headwind

What's the Investment Thesis Now?

Bull case: URI remains the undisputed market leader with 20%+ share, significant competitive moats from scale and technology, and structural tailwinds from infrastructure investment and onshoring. The 2028 targets of $20B revenue and $10B EBITDA imply meaningful upside if execution improves .

Bear case: Margin compression may be more structural than cyclical as ancillary becomes a larger revenue mix. Local market weakness persists while large project concentration increases execution risk. EPS declining despite revenue growth raises profitability questions.

Key Dates to Watch

- February 2026: Detailed 2026 CapEx and cold-start plans

- April 2026: Q1 2026 earnings (first data point on 2026 execution)

- 2028: Aspirational targets of $20B revenue, $10B EBITDA

Data sourced from United Rentals Q4 2025 8-K filing (January 28, 2026), earnings presentation (January 29, 2026), earnings call transcript (January 29, 2026), and S&P Global estimates.